2025 Federal Consumer Protection Updates: Minimize Business Risks

The 2025 updates to federal consumer protection laws are critical for businesses to understand and implement proactively, ensuring compliance and effectively minimizing potential legal risks and penalties in a rapidly evolving regulatory landscape.

As the business world constantly evolves, so too do the regulations designed to protect consumers. For businesses operating in the United States, understanding and adapting to federal consumer protection 2025 updates is not merely a suggestion but a critical imperative for minimizing legal risks and fostering consumer trust. These forthcoming changes promise to reshape how companies interact with their customers, from data privacy to advertising practices, demanding a proactive approach to compliance.

understanding the evolving landscape of consumer protection

The regulatory environment governing consumer interactions is in a perpetual state of flux, driven by technological advancements, shifts in consumer behavior, and emerging ethical considerations. The year 2025 is poised to bring significant alterations to federal consumer protection laws, impacting businesses across various sectors. These changes are designed to address current gaps in protection, enhance consumer rights, and hold companies to higher standards of transparency and accountability.

Businesses must recognize that staying informed about these impending changes is the first step toward mitigating potential legal exposure. Ignorance of the law is never a valid defense, and the penalties for non-compliance can be substantial, ranging from hefty fines to reputational damage and legal battles. A comprehensive understanding of the evolving landscape allows companies to anticipate challenges and strategically adapt their operations.

key drivers behind 2025 regulatory changes

Several factors are propelling the upcoming regulatory shifts. These include a heightened focus on data privacy in the digital age, concerns over deceptive marketing practices, and the increasing complexity of financial products and services.

- Data Privacy Concerns: The exponential growth of data collection and processing necessitates stronger safeguards for consumer information, with new regulations likely to expand privacy rights and impose stricter data handling requirements.

- Digital Marketing Ethics: As online advertising becomes more sophisticated, regulators are scrutinizing practices like targeted ads, dark patterns, and influencer marketing to ensure fairness and transparency.

- Financial Product Scrutiny: New financial technologies and products often outpace existing regulations, leading to calls for updated protections against predatory lending, unfair fees, and opaque terms.

Ultimately, the evolving landscape of consumer protection reflects a societal demand for greater corporate responsibility. Businesses that embrace these changes not only avoid legal pitfalls but also build stronger relationships with their customers, fostering loyalty and long-term success.

navigating data privacy and security regulations

Data privacy and security continue to be paramount concerns for consumers and regulators alike. The 2025 updates to federal consumer protection laws are expected to introduce more stringent requirements for how businesses collect, store, process, and share personal information. These regulations aim to empower consumers with greater control over their data and impose stricter accountability on companies.

For businesses, this means a need to re-evaluate current data handling practices, invest in robust cybersecurity measures, and ensure transparent communication with customers about data usage. Non-compliance in this area can lead to severe fines, class-action lawsuits, and irreparable harm to a company’s brand reputation.

critical aspects of data protection in 2025

The forthcoming regulations will likely expand upon existing frameworks, potentially introducing new definitions of personal data, broadening consent requirements, and strengthening breach notification protocols. Businesses should prepare for a multi-faceted approach to data compliance.

- Enhanced Consent Mechanisms: Consumers will likely have more granular control over how their data is used, requiring businesses to implement clearer and more explicit consent mechanisms, especially for secondary data uses.

- Data Minimization Principles: Companies may be encouraged or mandated to collect only the data absolutely necessary for a specific purpose, reducing the risk exposure associated with large data sets.

- Strengthened Data Security Standards: Expect increased regulatory emphasis on implementing advanced encryption, access controls, and regular security audits to protect consumer data from breaches.

Proactive engagement with these data privacy and security regulations is crucial. Businesses that prioritize data protection not only comply with the law but also demonstrate a commitment to their customers’ trust, a valuable asset in today’s digital economy.

advertising and marketing compliance in the new era

The digital age has transformed advertising and marketing, creating new avenues for consumer engagement but also new opportunities for deceptive practices. The 2025 federal consumer protection updates will undoubtedly target these areas, aiming to ensure that marketing communications are clear, truthful, and not misleading. This includes scrutinizing online advertisements, social media campaigns, and influencer marketing.

Businesses must review their marketing strategies and materials to ensure they align with the heightened standards of transparency and fairness. Ambiguous claims, hidden fees, or undisclosed endorsements could lead to regulatory action and consumer backlash. The focus will be on empowering consumers to make informed decisions without undue influence or misrepresentation.

key areas of marketing scrutiny

Regulators are particularly interested in practices that leverage behavioral psychology or obscure information to influence consumer choices. Companies should be particularly vigilant in these areas.

- Transparency in Endorsements: Clear disclosure of material connections between influencers and brands will become even more critical, ensuring consumers understand when content is sponsored.

- Avoiding Dark Patterns: Practices designed to trick users into making unintended actions, such as hidden subscription traps or confusing opt-out processes, will face increased enforcement.

- Truth in Advertising Claims: All marketing claims, especially those related to product performance, health benefits, or environmental impact, must be substantiated with verifiable evidence.

By adopting a consumer-centric approach to advertising and marketing, businesses can not only minimize legal risks but also build a reputation for integrity, which resonates strongly with modern consumers.

financial services and product transparency

The financial sector has always been a focal point for consumer protection, and 2025 is expected to bring further refinements to regulations governing financial products and services. These updates are likely to focus on enhancing transparency, preventing predatory practices, and ensuring that consumers fully understand the terms and risks associated with financial offerings. This includes everything from lending practices to investment products and digital payment systems.

Financial institutions and businesses offering financial products must meticulously review their disclosures, contracts, and customer communication processes. The goal is to eliminate jargon, clarify complex terms, and present information in an easily digestible format, enabling consumers to make well-informed financial decisions.

strengthening consumer trust in financial products

The regulatory emphasis will be on protecting vulnerable consumers and ensuring fair treatment across all financial transactions. Expect stricter rules around fees, interest rates, and the presentation of product benefits versus risks.

- Clear Disclosure of Fees: All fees, charges, and potential penalties associated with financial products must be prominently and clearly disclosed, avoiding fine print or obscure language.

- Understandable Terms and Conditions: Complex financial contracts should be simplified, using plain language to explain key terms, obligations, and rights to consumers.

- Fair Lending Practices: Regulations will continue to combat discriminatory lending practices and ensure equitable access to credit and financial services for all eligible consumers.

Businesses in the financial sector that prioritize ethical practices and clear communication will not only meet regulatory requirements but also cultivate a stronger foundation of trust with their clientele, leading to sustainable growth.

implementing a robust compliance program

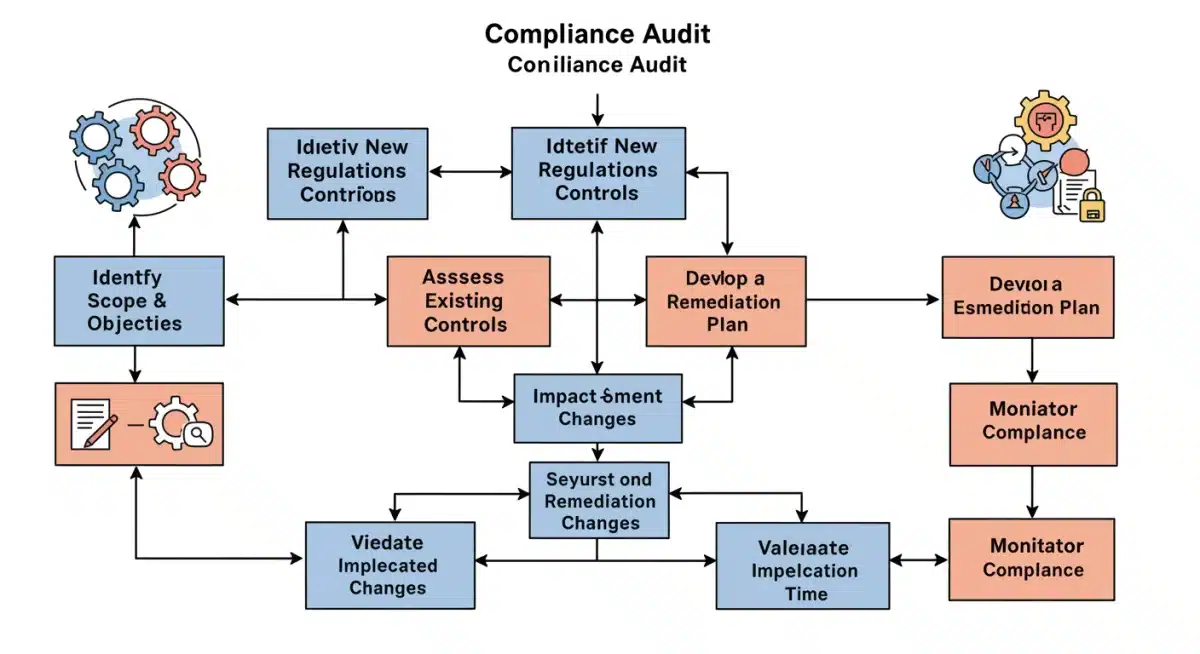

Minimizing legal risks in the face of evolving federal consumer protection laws requires more than just a superficial understanding of the rules; it demands the implementation of a robust and dynamic compliance program. Such a program acts as a company’s first line of defense, ensuring that all operations, from product development to customer service, adhere to the latest legal standards. A well-structured compliance framework not only prevents violations but also demonstrates due diligence to regulators, potentially mitigating penalties if an issue arises.

Developing an effective compliance program involves several critical components, including regular training, internal audits, and a clear chain of command for addressing compliance issues. It’s an ongoing process, not a one-time fix, requiring continuous adaptation to the changing legal landscape.

essential components of an effective compliance program

A successful compliance program integrates legal requirements into the daily operations and culture of the business. It’s about fostering a proactive mindset rather than a reactive one.

- Regular Legal Audits: Conduct periodic internal and external audits to identify potential areas of non-compliance and assess the effectiveness of existing controls.

- Employee Training and Education: Provide ongoing training to all relevant employees on consumer protection laws, company policies, and ethical conduct, ensuring everyone understands their role in compliance.

- Clear Policies and Procedures: Establish comprehensive, easy-to-understand policies and procedures that guide employee actions and decision-making in compliance-sensitive areas.

- Whistleblower Protections: Implement mechanisms for employees to report concerns confidentially without fear of retaliation, fostering an environment where issues can be identified and addressed early.

A robust compliance program is an investment in the long-term health and reputation of a business, safeguarding it against the complexities and potential pitfalls of the regulatory environment.

proactive strategies for risk mitigation

Beyond simply reacting to new regulations, businesses must adopt proactive strategies to mitigate legal risks associated with federal consumer protection laws. This involves anticipating future trends, engaging with regulatory bodies, and fostering a company culture that prioritizes ethical conduct and consumer well-being. A proactive stance not only reduces the likelihood of legal issues but also positions the business as a responsible and trustworthy entity in the marketplace.

Risk mitigation is an ongoing process that requires continuous monitoring of legislative developments, industry best practices, and consumer sentiment. It involves looking beyond the letter of the law to embrace the spirit of consumer protection, building a framework that is resilient to future changes.

building a future-proof compliance framework

To truly minimize risks, businesses should aim to build a compliance framework that is adaptable and forward-thinking, capable of absorbing new regulations without significant disruption.

- Anticipate Legislative Trends: Stay informed about proposed legislation and emerging consumer issues to predict future regulatory focus areas. This foresight allows for early adaptation.

- Engage with Industry Associations: Participate in industry groups and trade organizations that advocate for balanced regulations and share best practices for compliance.

- Foster an Ethical Culture: Promote a strong ethical culture throughout the organization, where consumer protection is seen as a core value, not just a legal obligation.

By implementing these proactive strategies, businesses can not only navigate the 2025 federal consumer protection updates successfully but also build a sustainable model that protects both their bottom line and their most valuable asset: consumer trust.

the impact of 2025 updates on small and medium enterprises

While large corporations often have dedicated legal departments to manage compliance, small and medium enterprises (SMEs) face unique challenges when adapting to new federal consumer protection laws. The 2025 updates will demand significant attention from SMEs, requiring them to allocate resources effectively to understand, implement, and maintain compliance without the extensive budgets of larger entities. The perception that these laws primarily target big businesses is a dangerous misconception; non-compliance penalties apply universally, and for SMEs, even a single violation can have devastating consequences.

It is crucial for SMEs to recognize that these regulations are not designed to hinder growth but rather to ensure a fair and transparent marketplace for all. By embracing the updates, SMEs can enhance their credibility, build consumer loyalty, and even gain a competitive edge over those who lag in compliance.

tailored strategies for sme compliance

SMEs can employ several practical strategies to navigate the 2025 updates efficiently, focusing on cost-effective solutions and leveraging available resources.

- Utilize Free Resources: Leverage government websites, small business associations, and legal aid organizations that often provide free guidance and templates for compliance.

- Focus on High-Risk Areas: Prioritize compliance efforts in areas most relevant to their specific business model, such as data handling for online retailers or advertising for service providers.

- Seek Expert Consultation: Consider engaging with legal counsel specialized in consumer protection for targeted advice, even if for limited consultations, to ensure critical areas are covered.

- Implement Simple, Scalable Processes: Develop straightforward, easy-to-follow internal procedures for compliance that can be scaled as the business grows, avoiding overly complex systems.

For SMEs, the key to minimizing legal risks lies in smart, strategic compliance. By being informed and proactive, even businesses with limited resources can successfully adapt to the 2025 federal consumer protection updates and thrive in a regulated environment.

| Key Aspect | Brief Description |

|---|---|

| Data Privacy | Stricter rules on data collection, storage, and consumer consent to protect personal information. |

| Advertising & Marketing | Increased scrutiny on truthful claims, influencer disclosures, and the avoidance of deceptive ‘dark patterns’. |

| Financial Transparency | Enhanced disclosure requirements for financial products, aiming for clearer terms and fee structures. |

| Compliance Programs | Necessity for robust internal programs, including audits and training, to ensure ongoing adherence to laws. |

Frequently Asked Questions About 2025 Consumer Protection Updates

The main goals are to enhance consumer rights, ensure greater transparency in business practices, strengthen data privacy safeguards, and prevent deceptive marketing and financial practices, adapting regulations to the complexities of the modern digital economy and protecting consumers from emerging risks.

Small businesses will need to review and potentially revise their data handling, marketing, and financial disclosure practices. While resource-intensive, compliance is crucial to avoid penalties. Leveraging free resources and focusing on high-risk areas relevant to their operations can help SMEs adapt efficiently.

Businesses should conduct internal audits of current practices, educate employees on new regulations, update policies and procedures, and consider consulting legal experts. Proactive engagement with regulatory developments and industry best practices is key to effective preparation.

While the 2025 updates are expected to strengthen U.S. data privacy, moving towards greater consumer control and corporate accountability, it’s not yet clear if they will fully mirror the comprehensive scope and mechanisms of GDPR. However, a trend towards more robust privacy rights is evident.

Non-compliance can lead to significant penalties, including substantial financial fines, mandatory operational changes, class-action lawsuits, and severe reputational damage. For businesses of all sizes, these consequences can be detrimental to their long-term viability and consumer trust.

conclusion

The 2025 updates to federal consumer protection laws represent a pivotal moment for businesses across the United States. These changes, driven by technological evolution and a heightened demand for corporate accountability, are designed to create a fairer, more transparent marketplace. While navigating new regulations can seem daunting, particularly for small and medium enterprises, a proactive and strategic approach to compliance is not just about avoiding legal penalties; it’s about building enduring consumer trust and securing a sustainable future for your business. By understanding the evolving landscape, implementing robust compliance programs, and adopting proactive risk mitigation strategies, companies can transform potential challenges into opportunities for growth and enhanced reputation.