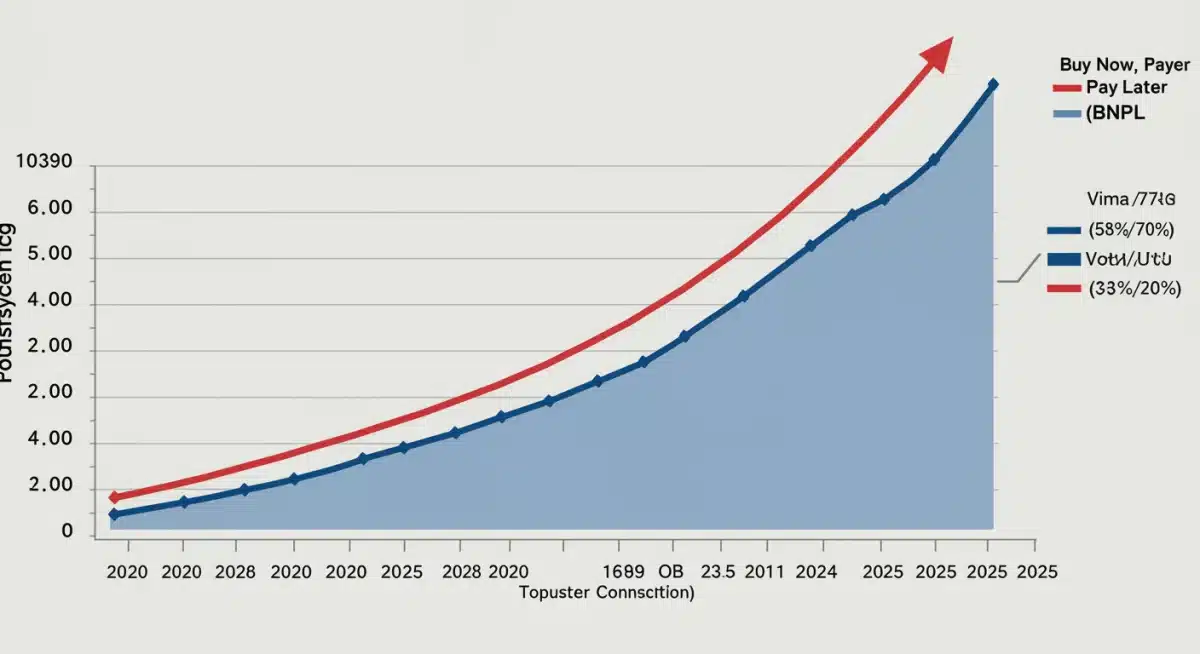

BNPL’s Surge: 12% of US Transactions by 2025

Buy Now, Pay Later (BNPL) is rapidly reshaping consumer spending habits in the United States, with forecasts predicting it will account for a substantial 12% of all US transactions by 2025, marking a significant shift in payment methods.

The landscape of consumer finance is undergoing a profound transformation, with BNPL US Transactions emerging as a dominant force. This shift is not merely a fleeting trend but a fundamental reorientation of how Americans approach purchasing, driven by technological innovation, evolving consumer expectations, and a desire for greater financial flexibility. As we delve into the mechanics and implications of this burgeoning payment method, it becomes clear that its impact will resonate across various sectors of the US economy.

the rise of buy now, pay later (BNPL) in the US market

The emergence of Buy Now, Pay Later (BNPL) as a mainstream payment option in the United States reflects a broader evolution in consumer finance. Once a niche offering, BNPL services have rapidly gained traction, appealing to a wide demographic seeking more flexible and transparent payment solutions than traditional credit. This growth is not accidental; it is the result of strategic market positioning, technological advancements, and a keen understanding of modern consumer needs, particularly among younger generations.

The appeal of BNPL lies in its simplicity and perceived accessibility. Consumers can often split purchases into several interest-free installments, making larger ticket items more affordable without the immediate burden of a lump-sum payment or the complexities of traditional credit card interest. This model has proven particularly attractive in the e-commerce space, where instant gratification and seamless checkout experiences are paramount. The convenience and straightforward nature of BNPL have positioned it as a compelling alternative to conventional credit, driving its rapid adoption across various retail segments.

driving forces behind BNPL’s rapid expansion

Several key factors are fueling the accelerated growth of BNPL in the US. Understanding these drivers is crucial to grasping the full scope of its market disruption.

- Consumer Demand for Flexibility: A significant portion of consumers, especially millennials and Gen Z, prefer payment options that offer more control and less commitment than traditional credit. BNPL caters directly to this desire for financial agility.

- E-commerce Integration: BNPL providers have seamlessly integrated into online checkout processes, making it incredibly easy for consumers to select this payment method. This frictionless experience is a major draw.

- Low or No Interest Offerings: The promise of interest-free installments, provided payments are made on time, stands in stark contrast to the often-high interest rates associated with credit cards, making BNPL a financially appealing choice for many.

- Merchant Adoption: Retailers are increasingly offering BNPL as a way to boost conversion rates, increase average order values, and attract new customers. The benefits for merchants are tangible and immediate.

The confluence of these factors has created a fertile ground for BNPL to flourish, transforming it from a novel payment method into a significant contender in the US financial ecosystem. Its growth trajectory suggests a sustained impact on consumer spending habits and the broader retail landscape.

In conclusion, BNPL’s rapid rise is a testament to its ability to meet unmet consumer needs and provide tangible benefits to merchants. Its user-friendly model and integration into digital commerce channels have propelled it into a prominent position, setting the stage for its projected significant market share by 2025.

projected market share: 12% of US transactions by 2025

The projection that BNPL will account for 12% of all US transactions by 2025 is a bold statement, yet it is backed by compelling data and observable market trends. This figure signifies not just growth, but a fundamental shift in how transactions are conducted across the nation. Such a substantial market share indicates that BNPL is no longer a fringe option but a core component of the American payment infrastructure, impacting everything from daily purchases to major investments.

This forecast is a culmination of several intertwined factors, including the continued expansion of e-commerce, the increasing comfort of consumers with digital payment solutions, and the aggressive marketing and integration efforts by BNPL providers. The ease of use, coupled with the psychological benefit of breaking down large costs into manageable chunks, makes BNPL an attractive proposition for a growing segment of the population, thereby driving its market penetration.

economic and consumer behavior insights

The economic landscape plays a crucial role in BNPL’s ascent. In an environment where inflation and economic uncertainty are often concerns, consumers are more inclined to seek out payment options that provide financial relief and predictability. BNPL offers just that, allowing individuals to manage their budgets more effectively without incurring immediate debt or high-interest rates, provided they adhere to the payment schedule.

Furthermore, consumer behavior has been significantly influenced by the digital age. The expectation of instant gratification and seamless online experiences extends to payment methods. BNPL platforms deliver on this by offering quick approvals and integrated checkout flows, minimizing friction and enhancing the overall shopping experience. This aligns perfectly with the modern consumer’s preference for speed, convenience, and transparency.

The 12% projection also suggests a diversification of BNPL usage beyond its initial stronghold in fashion and electronics. We are seeing its adoption in a broader array of categories, including travel, home goods, and even services. This expansion into new verticals is a strong indicator of its growing universality and acceptance among both consumers and merchants. The versatility of BNPL makes it a powerful tool for a variety of purchasing scenarios.

In essence, the projected 12% market share for BNPL is a strong signal of its transformative power. It underscores a shift towards more flexible, consumer-centric payment solutions that are well-suited to the demands of the modern economy and the evolving preferences of the American consumer. This trajectory confirms BNPL as a significant disruptor in the US financial services industry.

the impact of BNPL on traditional credit and lending

The dramatic rise of BNPL services is inevitably reshaping the competitive landscape for traditional credit and lending institutions. As BNPL captures a larger share of consumer transactions, it directly impacts the market for credit cards, personal loans, and other forms of short-term financing. This shift forces traditional players to re-evaluate their strategies, product offerings, and customer engagement models to remain relevant in an increasingly dynamic financial ecosystem.

One of the primary challenges for traditional credit providers is BNPL’s appeal to younger demographics who may be wary of high-interest credit card debt or lack extensive credit histories. BNPL offers an entry point into credit-like services without the same barriers or perceived risks, potentially diverting a significant portion of future credit card users. This demographic shift could have long-term implications for the market share and profitability of established financial institutions.

adapting to the new payment paradigm

Traditional lenders are not standing idly by. Many are exploring ways to integrate BNPL-like features into their existing products or launching their own BNPL offerings. This adaptation is crucial for several reasons:

- Retaining Market Share: By offering similar flexibility, traditional banks and credit card companies can prevent customer attrition to dedicated BNPL providers.

- Attracting New Customers: Developing BNPL options can help them tap into younger, digitally-native consumer segments who prefer these payment methods.

- Leveraging Existing Infrastructure: Traditional institutions have robust risk assessment frameworks and regulatory compliance expertise that can be applied to BNPL models, potentially offering a more secure and regulated experience.

However, this adaptation comes with its own set of challenges, including navigating regulatory scrutiny, managing credit risk in a new model, and competing with agile fintech companies built specifically for BNPL. The need for seamless digital integration and a customer-centric approach is paramount, areas where fintechs often hold an advantage.

The competition is also spurring innovation in traditional lending. We are seeing more personalized loan products, improved digital banking experiences, and a greater emphasis on financial wellness tools. The presence of BNPL is acting as a catalyst for the entire financial industry to become more responsive to consumer needs and technological advancements.

Ultimately, BNPL’s impact on traditional credit and lending is a tale of disruption and adaptation. While it presents a formidable challenge, it also creates opportunities for innovation and a more diversified financial services landscape. The future will likely see a hybrid model where traditional institutions incorporate BNPL features, and BNPL providers expand their offerings to resemble more traditional lending services.

regulatory landscape and consumer protection

As BNPL services proliferate and capture a larger market share, the question of regulation and consumer protection becomes increasingly pertinent. Unlike traditional credit products, BNPL has historically operated in a less regulated environment, raising concerns among consumer advocacy groups and financial authorities. The rapid growth of BNPL US Transactions necessitates a closer look at the frameworks needed to ensure fair practices and safeguard consumers.

The primary concerns revolve around transparency, potential for over-indebtedness, and dispute resolution mechanisms. While BNPL offers convenience, the ease of access can sometimes lead consumers to take on multiple payment plans, potentially exceeding their financial capacity. Regulatory bodies are now actively examining these areas to determine appropriate oversight that fosters innovation while mitigating risks.

navigating the evolving regulatory environment

Several key areas are under scrutiny as regulators seek to establish a balanced framework for BNPL:

- Disclosure Requirements: Ensuring that terms and conditions, including late fees and payment schedules, are clearly communicated to consumers upfront.

- Credit Reporting: Discussing whether BNPL repayment history should be reported to credit bureaus, which could impact consumer credit scores, both positively and negatively.

- Affordability Checks: Implementing guidelines for providers to conduct adequate affordability assessments to prevent consumers from accumulating excessive debt.

- Dispute Resolution: Establishing clear processes for consumers to dispute charges or resolve issues with BNPL providers, similar to those for credit cards.

The Consumer Financial Protection Bureau (CFPB) in the US has already initiated inquiries into the BNPL market, signaling a clear intent to understand and potentially regulate the sector. This scrutiny is a natural progression for any rapidly expanding financial service that impacts a significant portion of the population. The goal is to create a level playing field and protect vulnerable consumers without stifling the innovation that BNPL brings to the market.

It is anticipated that future regulations will aim to strike a balance between consumer protection and market growth. This might involve requiring BNPL providers to obtain specific licenses, adhere to stricter lending practices, and enhance their data security measures. The industry itself is also taking steps towards self-regulation, recognizing that a sustainable future depends on building consumer trust and addressing potential pitfalls proactively.

The regulatory landscape for BNPL is dynamic and will continue to evolve as the market matures. The ultimate outcome will likely be a more structured environment that offers greater consumer safeguards, ensuring that the benefits of flexible payments are enjoyed responsibly by all users.

BNPL’s role in e-commerce and retail strategies

The symbiotic relationship between Buy Now, Pay Later (BNPL) and e-commerce has been a primary catalyst for its explosive growth. For online retailers, offering BNPL is no longer a niche perk but a crucial component of a competitive and customer-centric retail strategy. The integration of BNPL at the checkout dramatically influences consumer purchasing behavior, leading to higher conversion rates, increased average order values, and enhanced customer loyalty.

In the fast-paced world of online shopping, friction at checkout can lead to abandoned carts. BNPL streamlines this process by offering an immediate, flexible payment option, removing a significant barrier to purchase. This ease of transaction is particularly valuable for items that might be considered discretionary or those with a higher price point, making them more accessible to a broader consumer base.

strategic advantages for merchants

Merchants who adopt BNPL services gain several strategic advantages that directly contribute to their bottom line:

- Increased Conversion Rates: By reducing the financial hurdle, BNPL encourages hesitant buyers to complete their purchases, leading to a noticeable uptick in sales.

- Higher Average Order Value (AOV): Consumers are often willing to spend more when they can spread out the cost over time, resulting in larger individual transactions.

- Broader Customer Reach: BNPL attracts new customer segments, including those who prefer not to use traditional credit or those who are building their credit history.

- Enhanced Customer Loyalty: A positive purchasing experience, facilitated by flexible payment options, can foster repeat business and stronger customer relationships.

Beyond e-commerce, BNPL is also making inroads into brick-and-mortar retail, with providers offering in-store payment solutions. This omnichannel approach ensures that consumers have consistent access to flexible payment options, regardless of how they choose to shop. The ability to offer BNPL across all sales channels further solidifies its position as an indispensable tool for modern retailers.

The data clearly shows that consumers actively seek out retailers that offer BNPL. For merchants, not providing this option can mean losing out on potential sales to competitors who do. Therefore, integrating BNPL is not just about keeping up with trends; it is about strategically positioning a business for growth in an evolving retail landscape. The continued growth of BNPL US Transactions is intrinsically linked to its value proposition for both consumers and merchants.

In summary, BNPL has become an integral part of modern retail strategies, empowering merchants to optimize sales, attract new customers, and enhance the overall shopping experience. Its role in driving e-commerce growth and adapting to consumer demands is undeniable and will only continue to expand.

the future outlook: innovation and challenges for BNPL

The trajectory of Buy Now, Pay Later (BNPL) suggests a future marked by continued innovation, but also by significant challenges. While the projected 12% share of US transactions by 2025 highlights its current momentum, the path forward will require providers to navigate an increasingly complex environment, characterized by evolving consumer expectations, intensifying competition, and heightened regulatory scrutiny. The industry’s ability to adapt and innovate will be crucial for sustained growth.

One key area of innovation will be the expansion of BNPL into new sectors beyond traditional retail, such as healthcare, education, and B2B transactions. As consumers become more accustomed to flexible payment options, the demand for BNPL in these less conventional areas is likely to grow. This diversification will open up new revenue streams and broaden the overall applicability of BNPL services.

overcoming obstacles and fostering sustainability

Despite its rapid growth, the BNPL sector faces several hurdles that need to be addressed to ensure its long-term sustainability:

- Regulatory Compliance: As mentioned, increased regulation is inevitable. BNPL providers will need to invest in robust compliance frameworks to meet evolving legal and ethical standards.

- Credit Risk Management: Managing the risk of defaults, especially as the user base expands and potentially includes individuals with less stable financial profiles, will be critical. Sophisticated underwriting models will be essential.

- Intensifying Competition: The market is becoming crowded with new entrants, including traditional banks and tech giants. BNPL providers will need to differentiate their offerings through superior technology, customer service, or niche market focus.

- Consumer Education: Ensuring consumers fully understand the terms and conditions of BNPL, including the implications of missed payments, is vital to prevent over-indebtedness and maintain trust.

Innovation will also extend to the technology underpinning BNPL. We can expect to see more sophisticated AI and machine learning applied to credit assessment, fraud detection, and personalized payment plans. The integration of BNPL with other fintech solutions, such as budgeting apps and digital wallets, will create a more seamless and comprehensive financial experience for users.

Furthermore, the focus on environmental, social, and governance (ESG) factors will likely influence BNPL providers, pushing them towards more responsible lending practices and greater transparency. Sustainability in the BNPL space will not just be about financial viability but also about ethical conduct and positive societal impact.

In conclusion, the future of BNPL is bright, but not without its challenges. Continued innovation, proactive engagement with regulators, and a strong commitment to consumer welfare will be essential for BNPL to solidify its position as a cornerstone of US payment methods and achieve its ambitious growth targets.

| Key Point | Brief Description |

|---|---|

| Projected Growth | BNPL is expected to comprise 12% of all US transactions by 2025, driven by consumer demand and merchant adoption. |

| Market Disruptor | It challenges traditional credit and lending models, forcing financial institutions to innovate and adapt their offerings. |

| Regulatory Scrutiny | Increased attention from regulatory bodies like the CFPB aims to ensure consumer protection and fair practices. |

| E-commerce Impact | BNPL significantly boosts conversion rates and average order values for online retailers, making it a key strategic tool. |

Frequently Asked Questions about BNPL

Buy Now, Pay Later (BNPL) is a type of short-term financing that allows consumers to make purchases and pay for them in installments over a period, often interest-free if payments are made on time. It’s an alternative to traditional credit cards, offering flexibility on purchases.

BNPL’s popularity stems from its convenience, interest-free payment options, and seamless integration into e-commerce checkouts. It appeals to consumers seeking budget flexibility and those wary of traditional credit card debt, especially younger demographics.

BNPL is challenging traditional credit card companies by capturing market share, particularly among younger consumers. This forces traditional lenders to innovate their offerings, potentially integrating BNPL-like features or developing their own flexible payment solutions to remain competitive.

Yes, risks include potential for over-indebtedness if multiple plans are taken on, late fees for missed payments, and possible negative impacts on credit scores if repayment history is reported. Consumers should always understand the terms before committing.

Regulatory bodies like the CFPB are actively scrutinizing the BNPL market. Future regulations are expected to focus on transparency, affordability checks, credit reporting, and dispute resolution to protect consumers and ensure responsible growth of the industry.

Conclusion

The projected growth of Buy Now, Pay Later (BNPL) to encompass 12% of all US transactions by 2025 underscores a pivotal shift in the American financial landscape. This emerging payment method, driven by consumer demand for flexibility and fostered by seamless e-commerce integration, is not merely a transient trend but a significant market disruptor. While offering undeniable benefits to both consumers and merchants, its rapid expansion also brings forth challenges related to regulation and responsible lending. The future of BNPL will be characterized by ongoing innovation, adaptation from traditional financial institutions, and a concerted effort to balance market growth with robust consumer protection. As it continues to evolve, BNPL is poised to redefine how Americans manage their purchases and interact with the broader financial ecosystem.